Imagine this…

A senior manager at a financial firm earns a big bonus for meeting annual sales targets. A few months later, an internal review finds the sales were boosted by breaking company rules – or the deals later collapsed.

Now the business faces a question:

Should they still pay the bonus?

or

Can they take the bonus back?

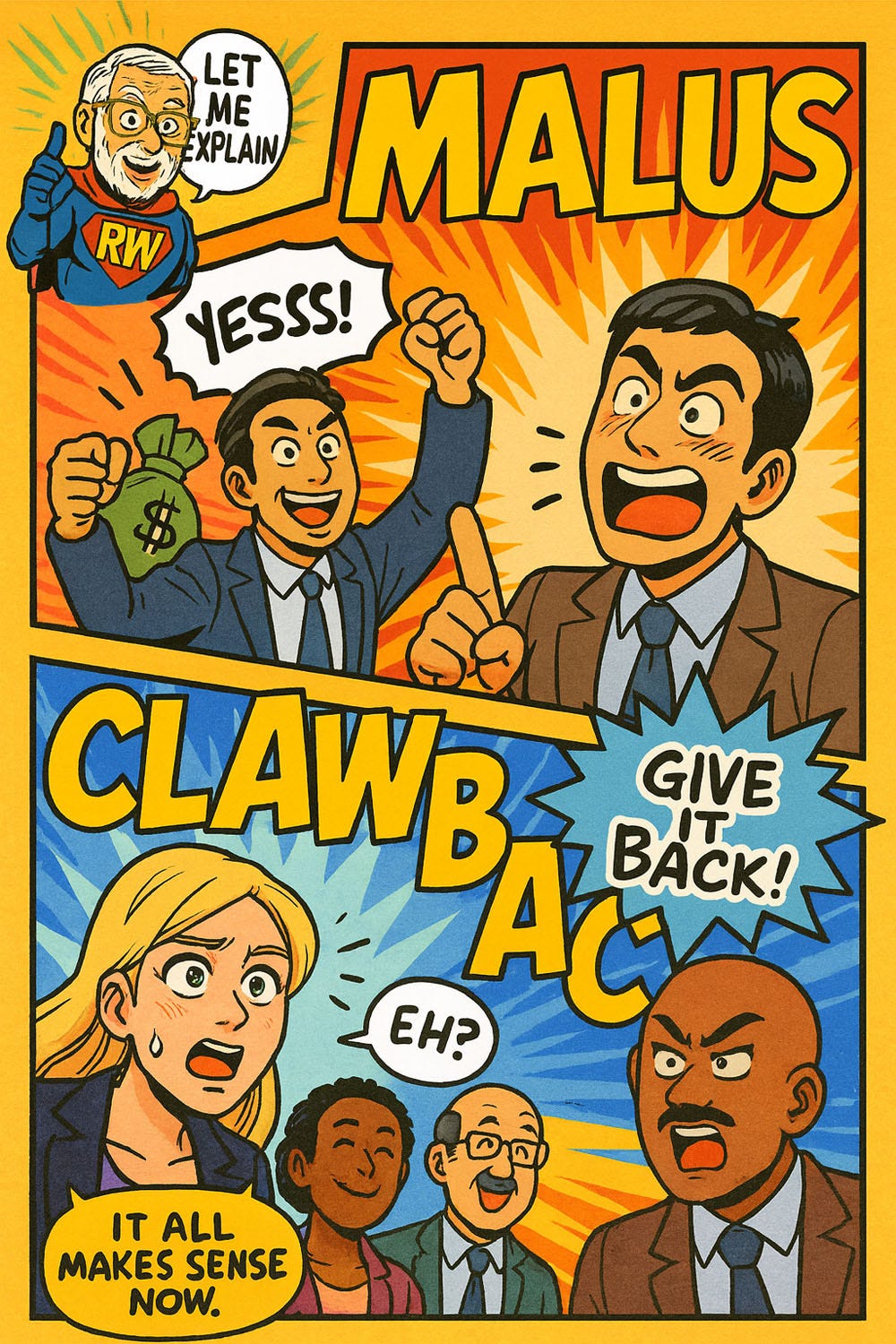

Welcome to Malus and Clawback – tools businesses use to keep bonuses fair and performance honest.

What is a Malus?

Think of a malus as a stop button for a bonus before it's paid.

If it turns out someone:

Broke company rules

Made serious mistakes

Caused damage to the business

Then: No bonus. Even if it was "earned" on paper.

What is a Clawback?

A clawback is tougher. It means taking back money already paid.

If a manager received a bonus for hitting targets, but later it’s found the numbers were wrong (or worse, dishonest)...

Then: The company can ask for the money back.

Why does this matter to you?

It protects your business from rewarding poor or risky behaviour.

It keeps people accountable, especially in high-responsibility roles.

It shows staff and stakeholders that integrity matters just as much as results.

Simple Rule of Thumb:

Only reward true, sustainable, and honest performance.

In Practice:

Make sure your contracts, bonus plans, or policies:

Explain when malus or clawback applies

Are clear and fair

Are communicated to everyone affected

Final Thought:

Malus and clawback aren’t just punishments – they’re protections.

They help build a business culture that’s strong, fair, and focused on long-term success.